US Treasuries in Sharp Decline

Advertisements

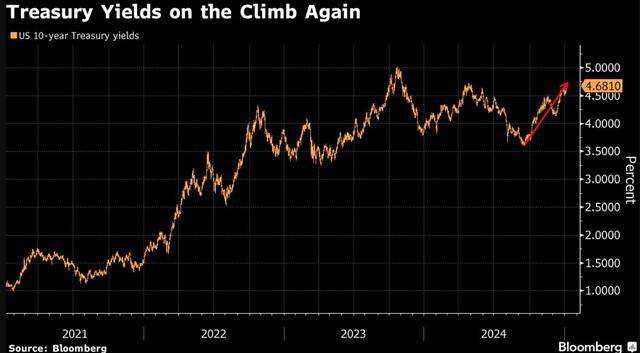

On January 9th, an intriguing phenomenon captured the global financial markets: the surge towards a 5% yield on U.S. Treasury bonds. This significant trend has drawn the attention of numerous stakeholders, particularly given the persistent decline in U.S. Treasury prices. Analysts, particularly those on Wall Street, have been fervently discussing the reasons behind this downturn and its connotations for future economic strategies.

Among those weighing in on the matter is Janet Yellen, the seasoned U.S. Treasury Secretary and one of the Federal Reserve’s former heads. Her insights into the market's current status provide clarity amid rising confusion regarding U.S. debt fluctuations. During a recent interview, Yellen articulated her perspective on the bond market's trajectory, especially regarding the rampant sell-off of U.S. Treasury bonds. She attributed this trend to a reassessment of expected interest rates following stronger-than-anticipated economic indicators.

Yellen elaborated on how recent robust economic data influenced market expectations. She noted that when indicators of economic performance exceed forecasts, it signals that future interest rates may be higher than previously predicted. This assertion aligns closely with the significant downturn in Treasury prices observed that very week, particularly on Tuesday, when reports indicated a thriving non-manufacturing PMI and favorable labor market statistics. Such developments led traders to reconsider their previous assumptions that the Federal Reserve would likely lower interest rates before the end of July.

Amid the market volatility, the yield on the 10-year Treasury bond reached as high as approximately 4.73%, marking the peak since April of the previous year. However, by the market's close, this yield slightly receded, ending the day with a marginal increase of 0.8 basis points at 4.696%. This fluctuation showcases the ongoing tension between investor expectations and actual economic performance.

Additionally, Yellen spotlighted the phenomenon of term premium normalization. She observed that the term premium – the extra yield that investors demand for holding long-term bonds over short-term ones – had been exceedingly low for some duration. Nevertheless, with the current economic landscape improving, this premium is beginning to rise again, indicating a shift in investor sentiment toward longer-duration investments.

Despite the past few months showing limited progress against inflation in the U.S., Yellen expressed her confidence that inflation rates are in a decreasing trajectory and that the labor market is not the root cause of rising prices. She emphasized the importance of sound fiscal policies, underscoring her hope that the incoming administration would tackle the issue of the national deficit seriously. Yellen fears a return to past phenomena where investors, anxious about public borrowing, demanded higher yields on government bonds—a scenario reminiscent of the “bond vigilantes” era decades ago.

This view resonates with a broader consensus among financial analysts: while Yellen refrained from delivering direct critiques of the new government's policy agenda, industry insiders largely believe the recent surge in Treasury yields is closely linked to anticipated economic policies. Nobel laureate Paul Krugman, in a recent article, echoed similar sentiments, cautioning that rising long-term rates could reflect growing skepticism about economic policies associated with the new administration.

Krugman specifically pointed to the incoming president's comments on tariffs, speculating that the markets are responding to potential shifts in trade policies. He referenced the relatively uniform consensus among economists that a combination of high tariffs, tax cuts, and mass deportation agendas could incite severe inflationary pressures, although not imminent. He surmised that should any significant component of this agenda be enacted, the Federal Reserve would likely need to halt further rate cuts, potentially leading to a reevaluation of interest rate elevation.

This back-and-forth between perceived action and economic policies reveals a crucial intersection of finance and politics. What may seem like mere fluctuations in bond yields at first glance is, in reality, a reflection of deeper sentiments regarding national fiscal responsibility and investor trust in government stability. The interplay between economic indicators, investor behavior, and governmental responses can create a volatile mix affecting markets and national debt management.

As the world watches the developments emerging from Washington, the implications of Yellen’s insights, the market’s reaction, and the incoming administration’s policies will resonate throughout the financial world. Investors will remain vigilant, interpreting economic data through the lens of political actions, while policymakers will need to navigate the complexities of economic realities guided by the sentiments expressed through market responses.

For now, as the Treasury yields play a pivotal role in shaping market sentiments, the importance of responsible fiscal planning, economic strategy, and a keen understanding of market psychology cannot be overstated. Only time will tell how these themes will unfold in the ever-evolving narrative of the U.S. economy.

Leave a Comment